Calm Down! The Real Estate Market is NOT Falling Apart

It’s happened again. Market adjustments in other sectors and everyone panics about the ‘upcoming housing bubble’. And I’m just sitting here wishing that the ubiquitous fake news would find the real story. ; ) While naysayers are front and center, the real experts are leaning in. They emphasize that the current appreciation levels are healthy and that vacancy rates are low, the opposite of what would cause a housing bubble. Here in Fort Collins, I’m just watching current homeowners enjoy nice equity gains. And I feel confident that upcoming buyers will enjoy their own equity gains…just a little later. Meanwhile, there is still a seemingly endless line of buyers standing at the door, waiting desperately to get into the market. Housing bubble? What housing bubble! Let’s look a little deeper. There has been tremendous volatility in certain markets over the last few weeks (for example, the stock and currency markets). When this happens, some tend to lump all of their investments together and create an almost ‘Armageddon’ scenario where everything loses value quickly and dramatically. Real estate is an investment that can get caught up in this hysteria. Does the concern about the current housing market have merit? Financial advisors have been warning us for months that the stock market was ripe for a “correction.” Experts have been questioning the value of alternative currencies for over a year. In contrast, here are the opinions of three major players in the residential housing market:

Ralph DeFranco, Chief Economist, Arch Capital Services Inc.

“It’s premature to worry about a housing bubble. The typical warning signs – excessive debt levels, poor quality loans, exponentially increasing home prices, rising vacancy rates and/or poor affordability compared to the past, and a high number of internet searches on house flipping – are not present.”

Liu-Down, Genworth Chief Economist

“My thoughts on many recent discussions of ‘housing bubble’ – the bar for a housing bubble is higher than just prices being above some fundamental value. There must be widespread behavior change as well such as higher levels of fraud and speculation.”

Fitch Report

“US home prices are on track for a 5% nominal gain for the 4th consecutive year, returning national prices to their highest level since 2007. The growth has been driven by historically low mortgage rates and unemployment plus solid population and personal income growth rates…a meaningful correction should only be triggered by an unexpected economic shock.”

Bottom Line

Speculation has driven certain markets over the last year. However, it has not been speculation, but instead people’s desire for homeownership, that has driven the real estate market. I see it every day. People are desperate to get into this market. Their loans are solid. Their debt ratio is healthy. And the homes they are buying are highly sought after. That’s called a good purchase! Looking to make a good purchase? Or possibly sell and take advantage of all that equity? I’m ready to make that happen for you with my Gold Key Service. Let’s get more buyers competing over your Colorado treasure and that leads to better offers, easier closings, and more net to you at the closing table. Call today to make it happen for you.

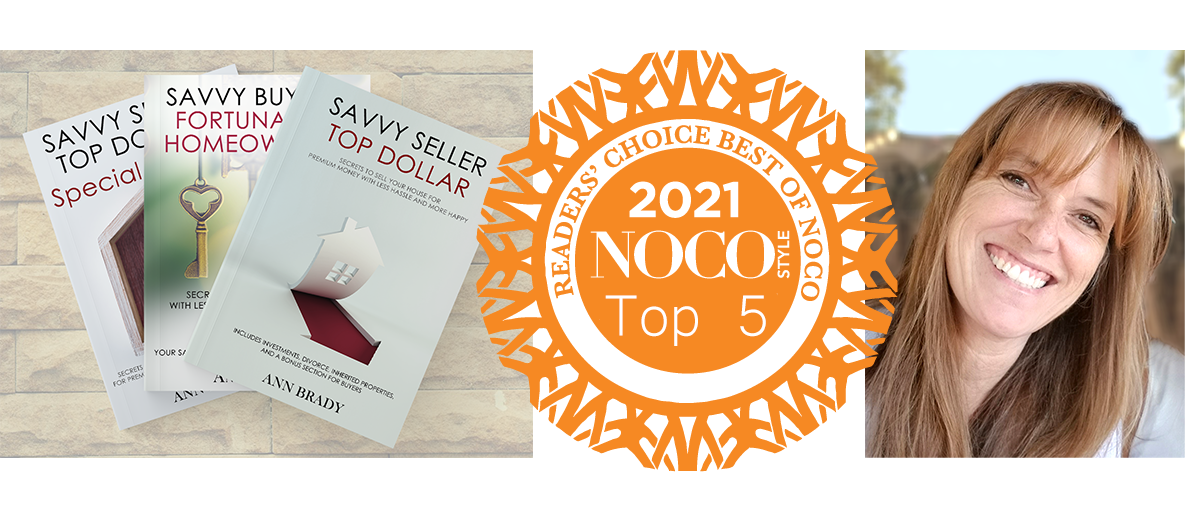

I literally wake up in the middle of the night with marketing ideas for my listings. Using modern marketing tactics, I pride myself on setting the gold standard for Real Estate marketing.

I literally wake up in the middle of the night with marketing ideas for my listings. Using modern marketing tactics, I pride myself on setting the gold standard for Real Estate marketing.

Nearly 50% of the properties that I marketed last year went under-contract opening weekend. Trust me. My clients were delighted.

Personally, I love to dance (tango, west coast swing, lindy hop), surf (well, I try to), and laugh (every chance I get)!

Joyfully,

Ann