I love weddings. The ritual. The optimism. The excuse to dance and smile with people that I love.

But as a real estate professional, I’m concerned about some of the… ahem… rituals that go along with the wedding. And even the wedding itself.

Do weddings kill financial futures? Is this what we’re setting our young people up for? Let’s look a bit deeper.

Married couples once again dominated the first-time homebuyer statistics last year at 66% of all buyers, according to the most recent Profile of Home Buyers & Sellers. It is no surprise that having two incomes to save for down payments and contribute to monthly housing costs makes buying a home more attainable.

Many couples are deciding to use what would otherwise be their wedding fund as a down payment on their first home, as unmarried couples made up 8% of all first-time buyers last year. If you’re single, don’t fret; you can still buy your dream home! Single women made up 17% of first-time buyers in 2016, while single men accounted for 7% of buyers.

According to a survey by the Wedding Report, the average cost of a wedding in the United States at the start of the year was $25,961, which equates to a 10% down payment on a median-priced home.

A recent article from the New York Times found that many singles are now asking their parents to allow them to use the money they’ve saved up for their wedding day to instead buy a home. Now that’s a clever bride and groom.

In the case of Carrie Graham, a Protestant minister from Austin, TX, her parents had saved a ‘five-figure sum’ for her wedding and were more than willing to give her that money as a down payment on her dream home. Graham told The New York Times,

“Buying the home wasn’t me saying, ‘I’m never going to get married’ or I am going to get married.’ My own home had way more than equity benefits. It was a real gift to have a home in an extremely desirable neighborhood in a city that I love. It’s brought me joy.”

So, if a wedding is a down payment for a house, what the heck is a bachelorette party? Check out this article and reconsider that Instaperfect Vegas getaway. Maybe a spa day will be a better investment… and a huge step closer to home ownership.

Bottom Line

More and more first-time homebuyers are finding a way to purchase their dream homes, even if that means delaying their dream weddings. And more and more of my future client’s are skipping the Vegas Strip to help themselves buy an urban loft, or split level, or townhome with a community pool. One pool day or a lifetime of pool days. You be the judge.

And of course, if you’re ready to find that dream love nest, I’m ready to chase it with you. Let’s catch it. Trust me it’s easier to win at real estate than blackjack.

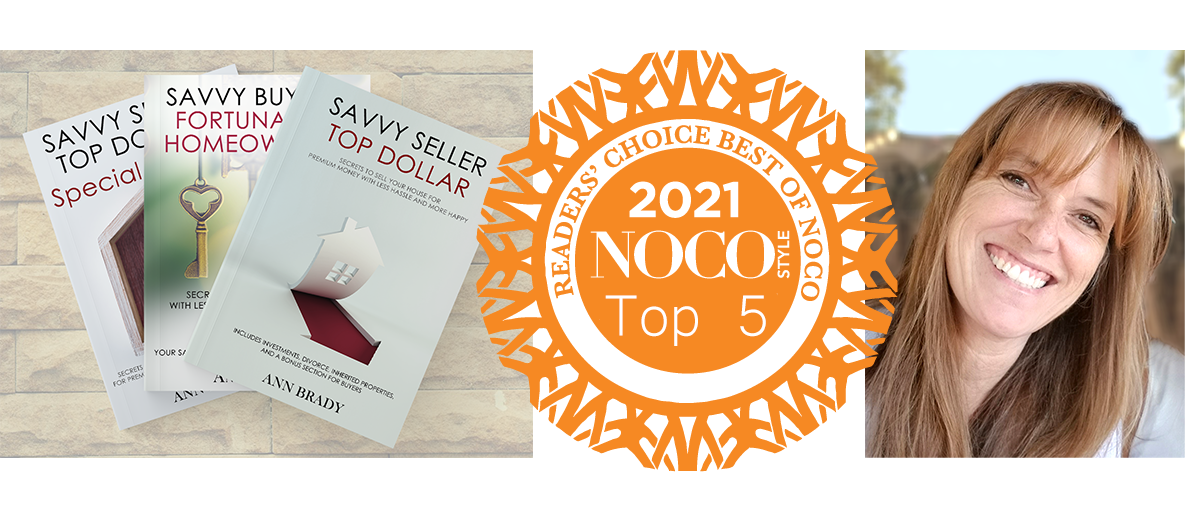

I literally wake up in the middle of the night with marketing ideas for my listings. Using modern marketing tactics, I pride myself on setting the gold standard for Real Estate marketing.

I literally wake up in the middle of the night with marketing ideas for my listings. Using modern marketing tactics, I pride myself on setting the gold standard for Real Estate marketing.

Nearly 50% of the properties that I marketed last year went under-contract opening weekend. Trust me. My clients were delighted.

Personally, I love to dance (tango, west coast swing, lindy hop), surf (well, I try to), and laugh (every chance I get)!

Joyfully,

Ann